BI Market 2026: How to Build Analytics You Can Trust

THE BI MARKET 2026: HOW RUSSIAN COMPANIES ARE BUILDING ANALYTICS THAT CAN BE TRUSTED, NOT JUST LOOKED AT

In 2026, the Russian business analytics market is experiencing not a crisis, but a catharsis. The period of borrowing global narratives and chasing “magical” tools is over. It is being replaced by an era of pragmatism, where value is measured not by the beauty of dashboards, but by the stability of management decisions built on data. Sanctions, staff shortages, regulatory pressure, and fragmented metrics have ceased to be “problems”—they have become a new operational reality, an architectural foundation on which we now have to build.

When global reviews predict the growth of the BI market to $116 billion by 2033, these figures sound like an abstraction to a Russian practitioner. Here and now, 82% of companies, according to SberAnalytics, are already using domestic BI platforms. But the essence of the transformation is deeper than a simple software replacement. A systemic shift is occurring: from analytics as a set of reports to analytics as a trusted management loop. This loop must be autonomous, secure, explainable, and, most importantly, work under conditions of scarcity—of resources, competencies, and time.

Thesis for 2026: The success of BI projects is now determined not by technological superiority, but by the ability to create a system of trust in data within the organization. Whoever solves this task will get not just reporting, but an operational lever in conditions of turbulence.

1. FOUNDATION: THE BATTLE FOR DATA QUALITY IN THE ERA OF SCARCE AI

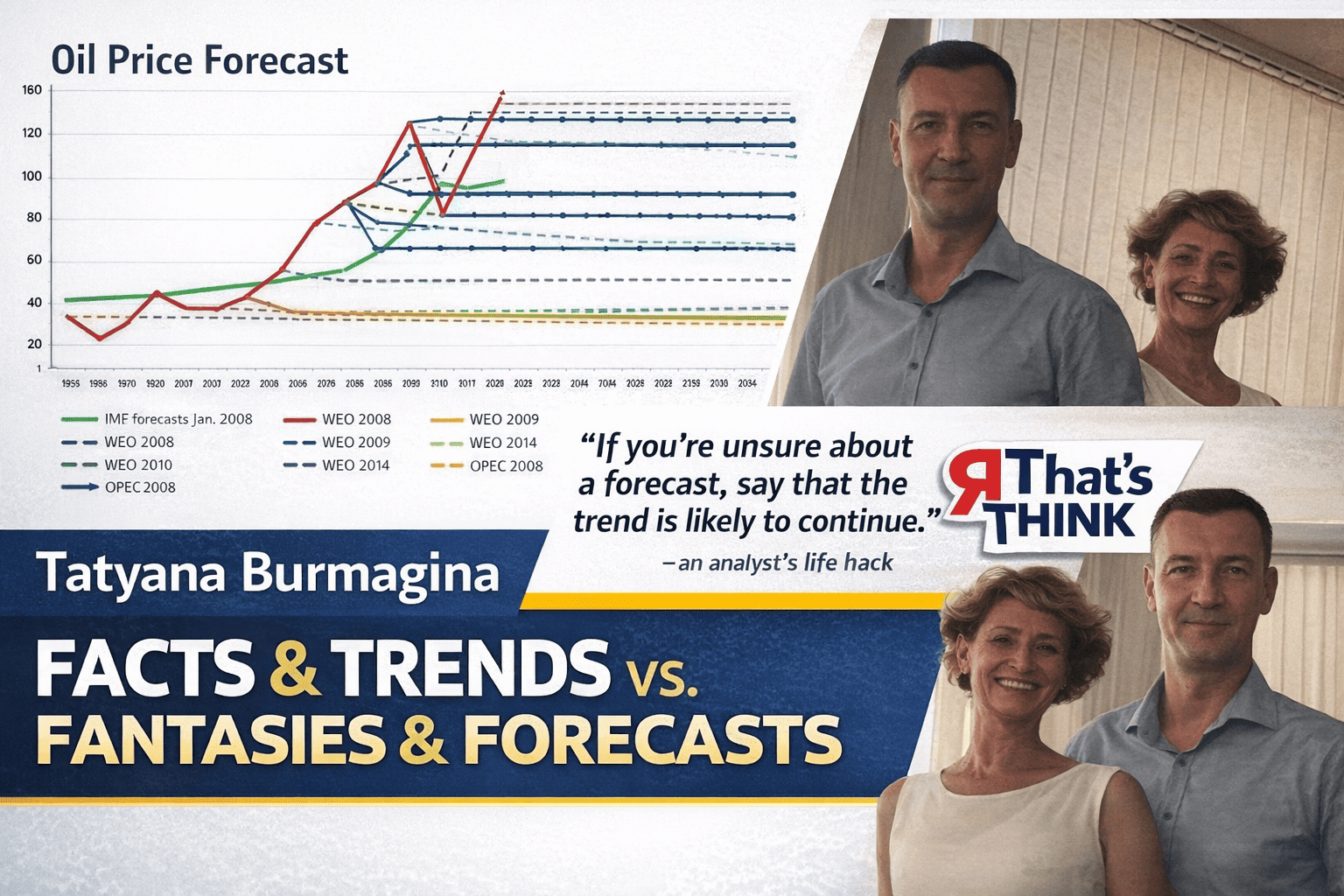

Global trend: Data as raw material for AI: structured, manageable, with impeccable lineage.

Russian reality: Excel as the de facto ETL tool, fragmented reference books, and up to 80% of analysts’ time spent on routine collection and “cleansing.”

Here lies the key contradiction. The demand for “artificial intelligence” and “predictive analytics” runs into the archaic state of the “natural intelligence” of data. Implementing even simple ML models requires a level of consistency and purity that often simply does not exist.

Architectural Conclusion 1: Investing in AI without prior investment in Data Quality and Data Governance is a guaranteed loss. The pragmatic path is the localization and automation of basic ETL loops. Not complex platforms, but efficient pipelines that reduce that very share of routine from 80% to 40%. This frees up the main resource—the analyst’s time—for working with content, not raw material.

Example: A large retailer implements a demand forecasting system. 6 months are spent not on training the model, but on unifying product catalogs from 15 different supplier systems, each with its own coding and update frequency. The project’s success was predetermined not by the complexity of the algorithm, but by the engineering work to create a single “golden” catalog.

Psychological aspect: Analysts, according to NEWHR data, although receiving salary growth, are trapped in an “operational trap.” Their mobility is falling (56.6% are not planning to relocate), and their role is blurring: they are simultaneously data engineers, data scientists, and business consultants. This is a path to burnout. The solution is not to hire “another analyst,” but in clear role separation and automation of low-level operations.

2. STRATEGY: FROM PROJECTS TO PRODUCTS AND FROM DASHBOARDS TO LOOPS

Global trend: Data as a Product (DaaP) — data as an independent product with an owner, SLA, and measurable value.

Russian reality: Point implementation in the public sector and among large players, where data becomes the basis for KPIs tied to money.

The market is tired of “dashboard-centricity.” Beautiful dashboards showing fragmented metrics are giving way to management loops. This means that each metric has:

1. A responsible owner (not the IT department, but a business unit).

2. A formalized calculation methodology, approved at the management level.

3. A direct link to a financial or operational result.

This approach kills two birds with one stone. First, it creates trust: when the methodology for calculating profit is the same for the finance department and the sales department, the ground for disputes disappears. Second, it is architectural discipline: data is designed not for a single report, but as a long-lived asset suitable for multiple scenarios.

Architectural Conclusion 2: The priority shifts from “implementing a BI platform” to “designing a system of indicators.” The first question should sound not like “What graphs do you want?”, but like “What decisions do you make based on this data and how do you measure their effect?”

Example: In a quasi-state company, the implementation of BI began not with purchasing licenses, but with a month-long cycle of workshops where department heads, together with lawyers and financiers, wrote down the regulations for calculating 12 key cross-cutting KPIs. The platform itself became merely the technical executor of this agreement.

3. TECHNOLOGIES: PRAGMATIC AI AND HYBRID ARCHITECTURE AS THE NORM

Trend 3.1: AI Without Illusions.

The global hype around augmented analytics in Russia runs into three walls: a shortage of competencies, sanctions on SaaS, and regulatory uncertainty. The answer is applied scenarios with proven ROI. The focus shifts from creating universal “brains” to implementing highly specialized solutions: demand forecasting in retail, anomaly detection in transactions, customer classification. Domestic low-code AI platforms lower the entry barrier, allowing business analysts to build models via a drag-and-drop interface. The key is measurability: a pilot must pay off in 6-8 months, otherwise it is just an R&D expense.

Trend 3.2: Self-Service as Semi-Service.

The myth that a business user will ask a question in natural language (NLQ) and instantly get the truth shatters against Russian morphology and chaos in metadata. The reality of 2026 is “semi-self-service.” Hybrid teams are formed: the business formulates a request in human language, and a dedicated analyst-moderator translates it into a correct data query, verifies the result, and provides context. This is not a failure, but maturity. NLQ technology based on SberAI/Yandex becomes not a replacement for the analyst, but his powerful amplifier.

Trend 3.3: Hybrid Cloud as an Imperative.

The 20-30% growth of the Russian cloud market in 2025 is not just a number. It is a response to a new architectural factor: the shortage and rising cost of “hardware.” Sanctions have driven up prices for server SSDs and memory. In-memory processing of big data is becoming a luxury. The answer is hybrid architectures. Critical data and the core are stored on-premises, while elastic computing, data marts, and test environments move to a managed private or domestic public cloud. This is not a matter of convenience, but of survival: this is how companies balance security, regulation, and economic feasibility.

Architectural Conclusion 3: The tech stack for 2026 is a triad:

1) A simplified, but impeccable core (cleaned data, standard metrics),

2) Applied AI modules with guaranteed ROI,

3) Hybrid infrastructure, optimized for resource cost. The integration of these elements is more important than the “feature” of any individual component.

4. MANAGEMENT: TRUST THROUGH TRANSPARENCY AND ARCHITECTURE THROUGH DISCIPLINE

Trend 4.1: Data Governance as a Competitive Advantage.

The requirements of 152-FZ (personal data), localization regulations, and sanctions risks have turned Data Governance from an abstract theory into a practical survival tool. We are talking about applied things: access matrices, action logging, traceability of data changes (data lineage). In public procurement and state-owned companies, this is no longer “nice to have,” but a mandatory admission criterion. Established processes are your competitive advantage, proving that your analytics can be trusted and your platform is safe.

Trend 4.2: Phased and Modular Approach vs. Monoliths.

Global vendors push ideas of comprehensive ecosystems. The Russian market votes for a phased and modular approach. Companies launch not “big BI,” but “analytics for the sales department,” then the “financial loop,” then “logistics.” Each module provides a quick effect and pays for itself. But this strategy works only if there is ironclad architectural discipline from the start: a unified data model, agreed-upon reference books, contracts at the junction of modules. Without this, modularity breeds new chaos.

Architectural Conclusion 4: Security and data manageability are the new non-functional requirement 1. A BI system that cannot prove the origin of numbers, log access, and report to the regulator is not a system, but a headache. Investments in data governance and compliance pay off not directly, but through access to markets, management trust, and avoiding colossal fines.

WHAT TO DO IN 2026? A ROLE-BASED GUIDE

For CEOs and Owners:

Analytics is not an IT cost, but an investment in management resilience. Your main task is to ensure the legitimacy of data. Create and approve regulations for key KPIs. Appoint business owners for data. Demand from any analytical initiative an answer to the question: “What specific decision will we make and what money will we save/earn?” Stop buying “tools,” start buying “results.”

For BI Architects and Heads of Analytical Departments:

Your value is shifting from knowledge of a foreign stack to the ability to build viable loops under constraints. Become an expert in hybrid architectures, domestic clouds, and compliance. Design not for growth, but for specific scenarios. Your key skill is not writing complex SQL, but the ability to agree with the business on a unified calculation methodology and build processes that support this methodology.

For BI Developers and Analysts:

Pump up hybrid expertise. “Data Engineer + knowledge of regulation” or “Analyst + understanding of ML basics on a low-code platform”—this is your new market profile. Move away from the role of a “request executor” to the role of a consultant and interpreter. Learn not only to calculate but also to explain, visualize, and package insights into formats accessible for decision-making (Obeya, JTBD methodologies).

For Vendors and BI Platform Developers:

The market is screaming for domain expertise and “complete” solutions. A universal platform is the base. But those who win are those who, on top of it, offer ready-made industry solutions: “BI for retail” with built-in demand forecasting models, “BI for utilities” with regulated reports for the regulator. Your product must solve data governance, security, and integration problems with the domestic stack out of the box. The execution environment has become more important than the beauty of the interface.

ARCHITECTURAL FORECAST

2026 will be a watershed year. The crisis of “trust in data” will force the Russian BI market to make a painful but necessary transition from the stage of “dashboard-centric” consumption to the stage of “loop-based” construction. Market growth will not be explosive, as in the world, but structural and moderate, estimated in tens of billions of rubles, not hundreds of billions of dollars.

The winners will not be those with more data or more complex algorithms, but those who are the first to build a system of data agreements in their organization, where a number from a report will carry the same weight and meaning as a signature on a contract.

New market leaders will form not around technologies, but around industry data standards and methodologies. The Russian experience of building BI under severe external constraints may become a unique competitive advantage and a model for other jurisdictions striving for digital sovereignty.

BI finally ceases to be an IT issue. It is a matter of operational management, corporate culture, and strategic discipline. In an era of uncertainty, a trusted analytical loop is not a reporting system. It is a system for managing reality.

Bureau of Management System Design